Moving to Pennsylvania means moving to a more affordable state which has comparatively cheaper real estate. But many factors apart from a low cost living need to be considered especially if living in Montgomery County. There are many theme parks and places with scenic beauty to discover in Pennsylvania which makes it great for small and large families. If you are going to start house hunting soon in Montgomery County, the following things are a must to know.

1. Make a Budget

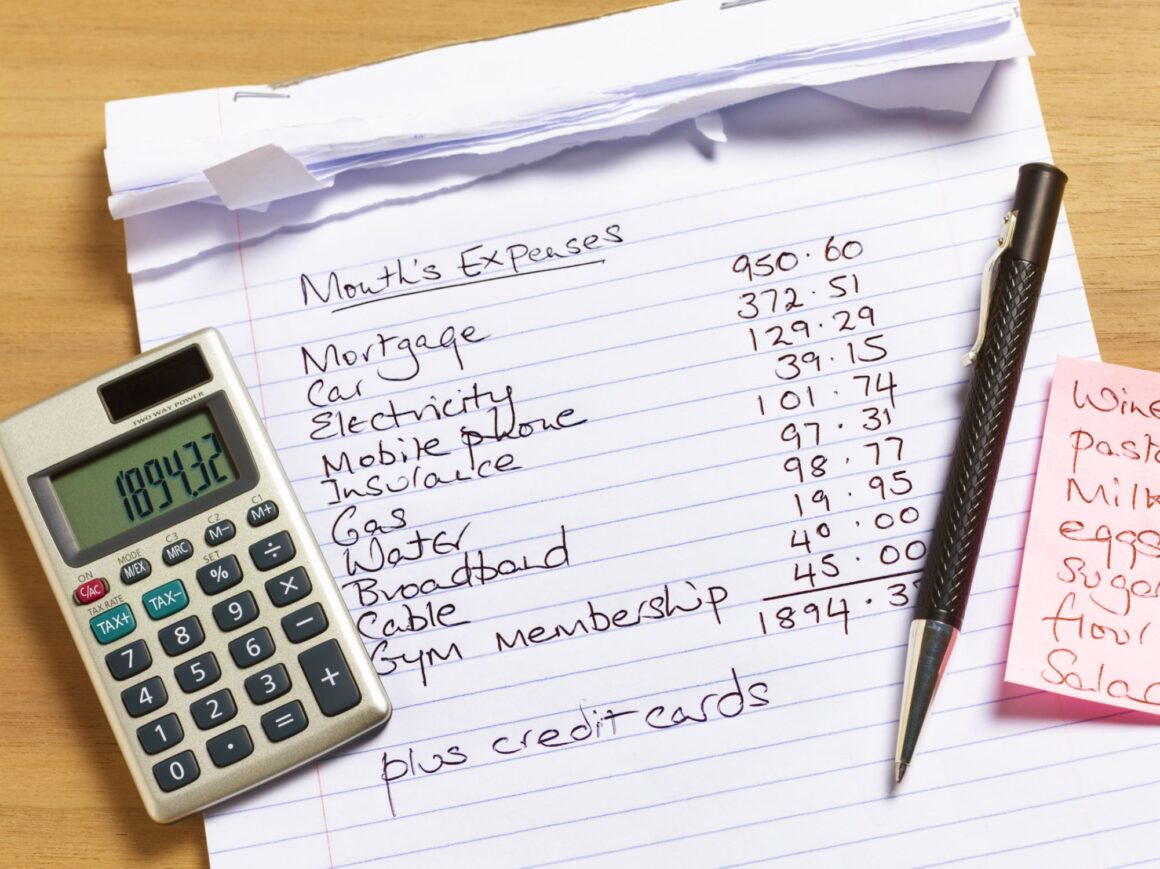

The first thing that one has to begin with is a budget based on how much we can afford in the area. Different sellers have different expectations for their property and there are other costs to bear in mind. Apart from the down payment, one has to consider the monthly expenses of mortgages and homeowner’s insurance.

There is private mortgage insurance included if the downpayment is below 20%. Property taxes will also have to be included so that one can budget accordingly. There are hidden costs of new home ownership which includes maintenance and lawn care.

The budget will also be dependent on how one qualifies for a mortgage. It is better to be pre-approved so that one can manage their expenses and savings accordingly. The best way to get pre-approved is by maintaining a good credit score which will eventually help you in managing the budget.

2. Choose a Good Real Estate Agent

It is almost as important as deciding that you want to buy a new house. Selecting an attorney and a real estate agent in a modern county will come in handy to smooth over any issues that may arise during house hunting. A real estate agent helps from the beginning and is helpful in mitigating the problems between the buyer and the seller.

They help in finding all the available places for sale within your budget and help in making an offer. You can hope for better negotiation if the real estate agent is on your side. If the area of Montgomery County is not familiar to you, getting an agent can help you explore it better and find a good residence. Montgomery County real estate will be easier to navigate with a reliable agent.

Getting a real estate attorney is another thing that you can consider if you want to get rid of possible legal issues. It is better to choose a reliable service which offers constructive advice and ideas. They should be able to understand your precise needs and should be committed to providing you with the best service.

3. Know the Buyer Programs

If you are moving states, understanding the first time home by a program in a higher state can help you out. There are payment assistance programs available as loans and grants for first time home buyers only. If you have not purchased any property in the past 3 years these programs can also be helpful.

The Pennsylvania Mortgage Tax Credit program offers a credit of 40% on the interest you pay on your mortgage. It will be up to 2000 USD every year. The Pennsylvania Housing Finance Agency (OHFA) also offers down payment assistance of 2.5% which can be included with the tax credit program.

The best part about this grant is that one does not have to pay it back if they don’t sell the house within 7 years. For recent graduates, there is an OHFA program with 5% down payment assistance.

It also offers a 30 year fixed mortgage at a discounted rate of 2.5%. The individual applying should be a graduate for no longer than 48 months. For specific first time buyer loans, the state of Pennsylvania offers facilities to combine mortgage tax credit and down payment assistance with them.

4. Choose a Good Offer Price

Once the matters of budgeting and financing are clear, one can go ahead with making an offer for final purchase. The real estate agent will be the most important person who can assist you in this specific process. They will look at your budget and conditions of pre approved mortgage to select properties with comparable pricing.

They will also help you in choosing the right contingencies that should be non negotiable in your offer. A contingency can be that the home inspection is satisfactory or that the current home by the buyer sells first so that they can use it to finance the subsequent purchase. The seller can then accept, counter, or negotiate the offer.

It is better to make a well rounded offer so that there are less chances of rejection. The grounds for negotiation are related to pricing and contingencies. It is better to adjust and form a mutually beneficial contract. There is also a chance of an escrow process of 2 months before one will close on their new home.

5. Get Ready for Closing

Based on the terms and conditions agreed upon between the buyer and the seller with the agent’s help, a legal document will be drawn up. Once a contract is finalized with the help of a lawyer, one can expect the closing to happen in a couple months.

The buyer will have to go to the escrow office to sign the final papers and have the title put under their name. The closing can only happen after the mortgage is approved, the contingencies are complete and all the funds are transferred between the two parties. You can then collect the keys and get ready to move in.

The Takeaway

Buying a property in montgomery county should be in adherence to rules of the state of Pennsylvania. Getting financially ready for house hunting is possible with payment assistance programs and getting approved for a mortgage. One will then have to employ a real estate agent and a lawyer for a more convenient buying process. Making an offer based on the budget is also necessary. After negotiation is done and contingencies are met, the deal can be finalized.