In the fast-paced world of trading, where every second counts and decisions can lead to substantial gains or devastating losses, traders are increasingly turning to simulators as a proving ground. But just how accurate are these trading simulators when it comes to predicting real-world performance? This question isn’t simply academic; it has profound implications for aspiring traders, seasoned investors, and everyone in between.

As the allure of virtual trading environments grows, so does the need to understand their intricacies. From the algorithms powering them to the real-time data they utilize, trading simulators promise a lot, yet they aren’t without their limitations.

In this article, we’ll delve into the mechanics of these tools, scrutinizing their reliability and helping you navigate the often murky waters of simulated trading. Prepare to uncover the truths behind the screens and discover what you truly need to know before diving in.

What Are Trading Simulators?

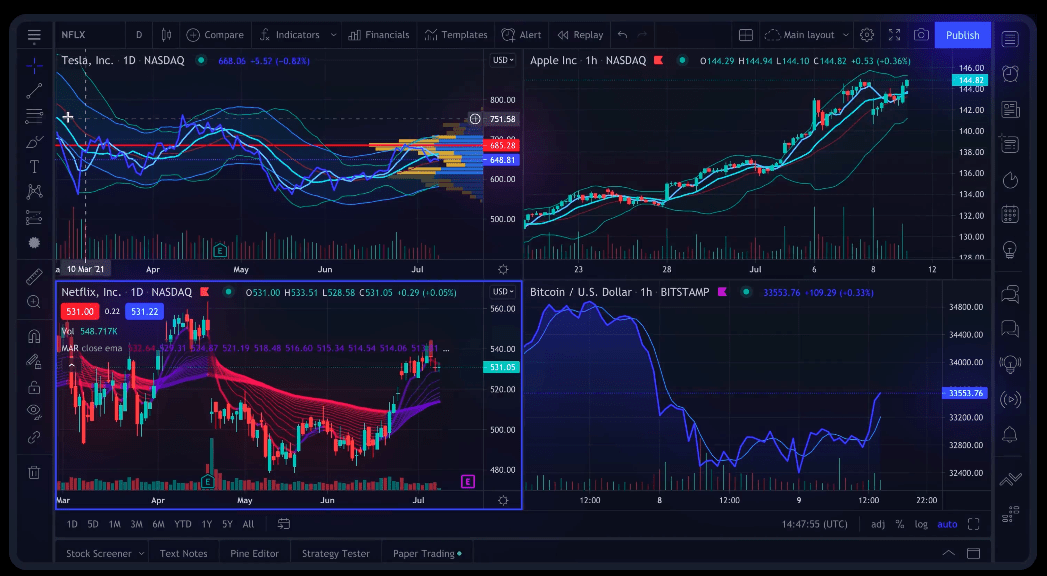

Bar replay free feature is an excellent addition to trading simulators, which are sophisticated platforms designed to mimic real-world market conditions, allowing both novice and experienced traders to practice their skills without the financial risks associated with live trading. These simulators provide users with a virtual environment where they can experiment with various trading strategies, analyze stock movements, and manage portfolios, all in real time.

Imagine having the chance to test your trading instincts against the ever-changing backdrop of market dynamics—it’s a little like being in a flight simulator, where the stakes are high, yet you’re safely grounded. With features ranging from access to historical data, including bar replay, to performance analytics, trading simulators serve as invaluable tools for honing decision-making skills and building confidence before diving into the actual trading waters.

Whether you’re a cautious learner or an aggressive strategist, these simulators cater to a wide spectrum of trading styles, making them a staple in the toolkit of anyone serious about mastering the art of trading.

Factors That Affect Market Performance

Market performance is influenced by an intricate interplay of several factors that can lead to unpredictable outcomes. Economic indicators, such as inflation rates and employment statistics, serve as the heartbeat of market sentiment, often triggering swift reactions from investors.

Additionally, geopolitical events, ranging from international conflicts to trade agreements, can create ripples that dramatically shift market dynamics. Investor psychology plays a vital role, as fear and greed can drive irrational behaviors, resulting in market volatility.

Not to be overlooked, technological advancements and innovations can also reshape sectors almost overnight, creating both opportunities and risks. Understanding these nuanced factors is essential for anyone looking to navigate the complex world of trading, particularly when relying on trading simulators that might not fully encapsulate the real-time challenges traders face.

The Role of Trading Simulators in Skill Development

Trading simulators play an essential role in skill development for aspiring traders, offering a safe haven where mistakes can be made without the catastrophic consequences that real market trading often entails. These virtual platforms immerse users in realistic market conditions, allowing them to experiment with various strategies, analyze outcomes, and refine their decision-making processes.

Imagine simulating the frenetic pace of a trading floor, where one minute you might be strategizing over technical indicators and the next, you’re rapidly adjusting to unexpected market shifts. Through constant practice, traders not only gain proficiency in executing trades but also develop critical thinking skills that help them navigate the complex and often unpredictable nature of financial markets.

As they progress, the confidence built in these simulators lays a solid foundation for a successful transition to the real world, making these tools invaluable in the quest for trading mastery.

Conclusion

In conclusion, trading simulators can serve as invaluable tools for both novice and experienced traders seeking to refine their skills and strategies without the financial risk inherent in live trading. While many simulators offer a realistic environment for practicing trading decisions, their accuracy can vary significantly based on factors like market conditions and the underlying technology used.

Its essential for traders to choose simulators wisely, taking into account features like risk management and real-time data. For those looking for a cost-effective way to enhance their trading capabilities, platforms that offer chart replay free feature can provide a unique opportunity to analyze past market movements and practice trading tactics. Ultimately, while trading simulators are an excellent educational resource, they should be complemented with thorough market research and a solid trading plan to prepare for the complexities of real-world trading.