In the fast-paced world of finance, where every second counts, automated trading systems have emerged as powerful tools for investors and traders seeking to navigate the complexities of the market. These sophisticated algorithms execute trades at lightning speed, utilizing vast amounts of data to identify patterns and opportunities that might elude even the most seasoned professionals.

Imagine algorithms analyzing market trends, forecasting price movements, and executing orders—all without human intervention. But how exactly do these systems operate? What makes them a game-changer in trading strategies? In this article, we will delve into the intricate workings of automated trading systems, exploring their components, advantages, and the role they play in reshaping the financial landscape. Join us as we uncover the fascinating world of automated trading and its implications for the future of investing.

Key Components of Automated Trading Systems

Automated trading systems rely on several key components that work in concert to execute trades efficiently in today\’s fast-paced financial markets. At their core, these systems are powered by algorithms—complex mathematical models that analyze vast amounts of data, identifying patterns and trends that human traders might overlook.

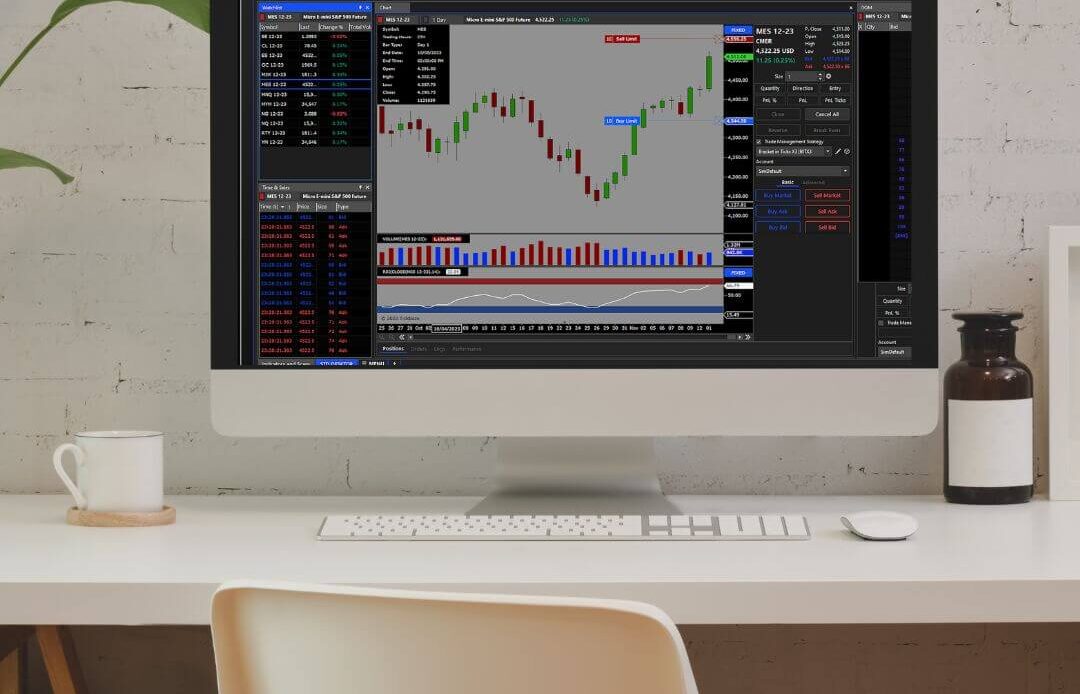

Data feeds play a crucial role, supplying real-time information on market prices, trading volumes, and economic indicators, while execution platforms are essential for carrying out trades instantly based on signals generated by the algorithms. Risk management tools provide safeguards against significant losses, allowing for adjustments in position sizes and predefined stop-loss levels. Additionally, user interfaces are vital, offering traders the ability to monitor system performance and make necessary adjustments or override automated decisions.

Together, these elements create a robust ecosystem that optimizes trading strategies while minimizing human error and emotional bias.

Types of Automated Trading Systems

Automated trading systems can be classified into several distinct types, each serving unique trading strategies and market conditions. At the forefront are algorithmic trading systems, which utilize complex mathematical models to execute trades at lightning speed, responding to real-time market data.

Then there are high-frequency trading (HFT) systems, a subset of algorithmic trading, designed to capitalize on minute price fluctuations through swift and often large volumes of trades. On the other hand, there the rule-based trading system, which follows predefined criteria, like specific indicators or chart patterns, to make decisions—offering a more controlled approach.

Furthermore, machine learning and artificial intelligence have introduced predictive trading systems that can adapt and learn from data patterns over time, continuously refining their strategies. Each type of automated trading system embodies a unique interplay of technology, strategy, and market insight, catering to diverse investor needs and risk appetites.

How Automated Trading Systems Work

Automated trading systems operate by leveraging sophisticated algorithms to analyze market data and execute trades based on predetermined criteria. At the heart of these systems lies a blend of technical indicators, historical data analysis, and risk management parameters, all coded into a software platform.

When certain market conditions are met—like price movements or volume changes—the system reacts swiftly, placing trades without human intervention. This speed and accuracy can be a decisive advantage in the volatile world of trading, bypassing the emotional biases that often afflict human traders.

Furthermore, many automated trading systems allow for backtesting, enabling users to simulate the efficacy of their strategies on past data to refine their approaches. In a landscape where every second counts, these systems not only enhance efficiency but also empower traders to explore complex strategies that would be nearly impossible to execute manually.

Conclusion

In conclusion, automated trading systems represent a revolutionary shift in the way financial markets operate, offering traders the ability to execute strategies with precision and speed far beyond human capabilities. By utilizing sophisticated algorithms and advanced technologies, these systems can analyze vast amounts of data, identify potential trading opportunities, and execute transactions in real time without the emotional biases that often affect human traders.

As financial markets continue to evolve, the adoption of automated trading systems is likely to increase, providing both individual and institutional investors with powerful tools to enhance their trading performance and optimize their investment strategies. Understanding how these systems work is essential for anyone looking to navigate the complexities of modern trading environments successfully.